The creator of the Dow Jones Industrial Average, Charles Dow, had some interesting “theories” on commerce. Dow’s theory gives hints on the duration of market trends in a medium by market means, these are known as indices.

Despite the large transformation that capital markets have undergone, Dow’s theory and assumptions are still valid, despite the fact that it was created 100+ years ago. Charles concluded that price movements can be estimated through intentionally created mediums/charts that are intended to depict the state of the real economy.

Dow’s theory has evolved in what is known today as market analysis. Therefore, anyone who wants to succeed in trading on the market using technical analysis should know the principles of Dow’s theory. Understanding it will allow you to show the strength of trends, directions and turning points on every chart.

According to Dow, the market as a whole, which is shown in the market average, can measure the condition of the economic situation. It is possible to precisely identify the direction in which the market is heading and determine the economic condition if market analysis is taken into account. Thanks to this, it is also possible to project traffic for individual shares that are part of mid-cap sized ones.

The theory of Fal Elliott (Elliot Wave Theory) and Dow’s theory are interwoven and used in the issues of analytical studies, related to the explanations of behavior presented by charts showing different concepts (trends, holes, peaks, resistance and support).

Any information that affects supply and demand is reflected in stock market averages. That means effective investing can only be based on research and analysis of the behavior of stock exchange markets. The most important thing is to watch the price because everything is contained in it. There’s no need to constantly examine and interpret the various information pieces that are ever-updating, such as reports on the state of the economy or macroeconomic readings.

1. The primary market trend is the long-term trend. This is a dominant trend on the market. It lasts for at least a year (it may last even a dozen years). The nature of this trend depends on the expected state of the economy in the phases of the business cycle.

2. The second is the medium-term trend. The duration of this trend is usually from 3 weeks and up to 3 months. It is a correction of the long-term trend. The previous price movement is usually eliminated by 1/2, 1/3 or 2/3, thanks to these adjustments.

3. The last is the short-term trend. It lasts up to several weeks and is a correction of the medium-term trend.

1. Accumulation. Experienced and professional investors start buying shares on the basis of conducted analyses.

2. Price Increase. Many investors start shopping, thanks to market analyses and good economic news. In this phase, numerous price adjustments follow.

3. Distribution. Due to the positive data coming out, investors are very active. At this point, professional investors start selling and accumulating high profits. Prices reach the upper limits of their capabilities and their decline begins.

Every signal, which may be a preview of a bear market or bull market, must be confirmed in two mediums (Industrial & Transport) to be sure of it’s correctness. Market averages must give each other confirmation!

The volume should be formed in accordance with the main trend. This means that in the bull market the volume should increase along with the price increase, and decrease in the case of falls, while in the bear market should behave exactly the opposite, that is, increase with declines, and decrease during the rise.

The trend maintains a given direction until an important signal for its reversal is obtained. Technical analysis allows you to capture the moment in which the trend is to change. For this purpose, among others, trend lines, support and resistance levels, moving averages and price formations help.

If you want to understand the Forex market, you need to learn about different formations, specifically Price Action formation strategies. Traders who use these methods mainly use candle and price formulas. The three basic formations of the Price Action strategy are Pin Bar, Inside Bar and Fakey.

Pin Bar is the basic formation on the Forex market. This formation is highly effective. It works best during strong trends or at levels of support and resistance. It is also worth noting that the appearance resembles a hammer or a evening star.

Inside the bar, this formation shows indecision on the market. The second candle of the formation is entirely between the maximum and the minimum of the preceding candle. They occur then when the market will perform a large trend movement. Shows the trend continuation or reversal. The second candle is entirely covered by the first candle. It’s good to use Inside Bar on weekly and daily charts because we get low risk and quite big profits.

Fakey is another basic price action strategy, which should be known from the Inside bar, and then from a fake kick, that is, the strategy is characterized by a significant upturn after a false break down.

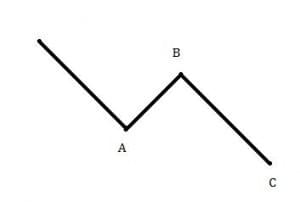

Ralph Elliott assumed that market movements take the form of five waves that have a specific structure. From among these waves, three determine the main direction of the market (these are the waves of the impulse).

A bit of mathematics:They are marked as 1, 3 and 5. They have a five-wave structure. The remaining waves marked as 2 and 4 are divergent with the dominant trend – they are correction waves that have a three-wave structure.

Eight waves is a full cycle which contains two separate phases, i.e. a pulse phase and a correction phase. At the beginning there are five rising waves of the impulse, while after their completion three drop waves appear.

These three waves are a correction of the earlier movement. The result of this is the start of the next higher-degree cycle. The whole structure of this market is based on the fact that two waves of a particular degree are separated into eight waves of the next, lower degree. These eight waves divide, in the same way, into thirty-four waves, the next, even lower degree.

The total market cycle consists of 144 waves, of which 89 are impulse waves, while 55 are correction waves. Unfortunately, it is not so easy to adjust this scheme to the actual market.

The first wave expresses the expectations of investors who are hoping that the current trend will be reversed. However, some of them claim that this is only a correction of the current trend. It is the first reflection after a strong movement, which ends quickly and falls appear.

The second wave presents a passing hope. After previous increases, declines begin to occur. Most investors are dominated by resignation. It turns out, however, that this wave is just a correction of the first wave. The rate will not be able to trigger an even lower price hole, thanks to which prices start to grow again.

The third wave is a wave symbolizing definitely the investors who took long positions. This is usually the strongest wave of all waves. A clear demand is visible on the market, and new investors are adding to the trend. In addition, there is a stop loss from the tip of the end of the first wave.

The fourth wave dampens the enthusiasm of investors. It presents the realization of the profits of those investors who decided to enter the market in earlier waves. There is uncertainty about the direction of the trend.

The fifth wave symbolizes greed. There is a lot of enthusiasm on the market, which is why new people are coming, who hope to continue growth. This wave is the last chance to gain profit in line with the current trend. When there are no more people who want to buy at these higher prices, fast declines are coming.

The first wave of correction depends on the nature of the fifth wave (it can be calm or very turbulent).

The correction wave can be misleading. It misleads investors that the previous trend is still valid. However, the price does not pierce the top of the fifth wave. Supply appears on the market.

Faith in further increases spurts like a soap bubble. There is doubt and fear of further declines. There is continuation in price declines.

These are some of the worst mistakes that a trader can make. These mistakes often lead to ineffective investments and a loss of money.

According to statistics, about 80% of people who start their adventure with the market lose the vast majority of their money in three to five months, as a result of which they leave the market.

Most of these people will never be tempted to return to investing in the stock market. They do not want to risk the loss of their hard-earned money again. Fear of another failure in investing does not allow them to risk their savings. Their hope of quickly and easily earned money burst like a soap bubble.

After the first transaction, there was a gray reality about the hardships in investing in the capital market. It is not as attractive as it seemed before the first investment of your money. Therefore, you have to think about how to invest wisely to be among the top 20% of people who are successful in the Forex market.

What should you do to avoid making basic mistakes that will condemn investors to losses and withdraw from the market?

People who are just starting to play on the market often do not have a sufficient range of knowledge and experience, which is why they notoriously record failures. Because of these constant failures, the money they spent investing ends, which forces these people to finish their adventure with the market, often without knowing what mistakes they made.

Fast and easy profit on Forex? After reading the statistics, we are brought back to the lands – since the opening of your brokerage account, about 80% of people lose the vast majority of funds during the year. In the Forex market, these figures look even more relentless, people who start investing lose much faster (from three to five months).

Nowadays, the market is not easy, the investor must have the right knowledge and have the skills to succeed and earn money. Knowing the trader’s basic mistakes makes it easier for him to achieve the desired result on the market.

Unfortunately, most people who invest in the market have no knowledge of these frightening data. People with the shortest trading resume are usually the most convinced about their victory. These same people are often in the group of “failed traders”, exiting the trade without profits.

There are a few basic mistakes to keep in mind when investing. Every successful trader who earns money and can boast more profits than losses always has in mind the basic mistakes that should be kept away. Forgetting this, definitely increases the risk of ineffective investing and, as a result, a departure from the market due to a large amount of money.

It should be known precisely to really look at this difficult market. It’s best to know the basic errors of traders before the first investment, to have the chance to be among the winners, in these 20% of new successful investors, at the beginning of their journey in the Forex market.

The name FOREX comes from the words “FOReign EXchange”. This is where currencies can be exchanged in bulk, bypassing organized trading systems like stock exchanges.

The International Settlements Bank in Basel conducted a survey in 2019, showing FOREX has more than 6 TRILLION EUR traded on it daily!

This is primarily due to the opening of the market to retail investors, as well as the recognition of the benefits behind this type of instrument for investment. Forex allows trading 24 hours a day. It’s closed Friday 4pm EST to Sunday 5pm EST.

Any information released in the news or online can have an impact on the quotes. Fortunately there is the ability to make an immediate reaction if such a situation does occur. Since FOREX is a centralized market, just like the stock exchange, that means that currency trading is not located in just one place.

Time zones have a big impact on market activity. Knowing this, traders will often say that the day’s trading starts in Singapore and Sydney, with record highs of activity in Tokyo, then in Europe, then Frankfurt and London and finally ending in New York. Hence the terms European, Asian or American Session.

There are various types of transactions on the OTC market – they are divided into timely and immediate ones. Futures transactions are based on the determination of transactions to be made in the future at a fixed price and on a specified date. The most popular transactions of this type are: futures, swaps, options and forwards.

On the other hand, instant transactions include transactions made after current rates and that are conducted by dealers.

One of the most effective tools for analyzing charts are candle formations. It is a great tool for beginners and advanced. The candle formation announces the conclusion of a transaction at a given moment. There are positive & negative formations. We’ll go over both in this article.

Any information released in the news or online can have an impact on the quotes. Fortunately there is the ability to make an immediate reaction if such a situation does occur. Since FOREX is a centralized market, just like the stock exchange, that means that currency trading is not located in just one place.

This formation consists of two candles (a smaller red candle then a larger green candle). It describes the formation of the downward trend. If we have a strong downward trend, then a shorter red candle is first created, then the next candle is opened to us, which may or may not mean an acceleration of the trend. This moment, however, means that there is a reflection. If we combine the candles with each other, then we will get a hammer formation.

This formation consists of two candles. The first candle is black, another white one that closes in the upper half of the first (black) candle. The second candle falls deeper into the first candle, the situation is stronger the combined candles form a hammer.

Indicates the end of the upward trend. There is a formation that consists of a single “candle”.

This formation consists of two candles (first green and then red). After a strong uptrend, a white candle is created, followed by a black one, which may suggest an acceleration of the trend as “Bull market”. A reversal occurs and a shooting star is created.

This formation consists of two candles. The first candle (green) opens above the closure, it suggests the continuation of the upward trend, the next candle (red) ends in the lower half of the first (green) candle. This moment informs us that a reversal of the trend may occur. occurs at the end of the upward adjustment.

When reading a pure Technical Analysis chart, the market indicates where the support is located. We do not guess, we do not forecast, we only follow the indications of the charts. As a rule, we search for the largest number of tangent points on the chart, regardless of whether they are the ends of shadows or corpses.

On the live graph, the testing action occurs on the level 1.4400 for GBP\EUR. This is a special because the prices at 1.1200 or 0.9000 are rates that are often tested in the exact same way. Forex is all about spotting the best pattern(s).

The first behavior is based on the sellers’ pressure (in a downward movement), so the chart pierces these 1.4400 levels and continues to fall at a fast pace without stopping. This is due to the publication of data or high sales pressure (for a multitude of reasons). It is easy to distinguish this behavior because the graph literally ‘flies’ through the given level.

Although there are actually many more versions of how the market meets, breaks through or even negates the full levels. To keep it simple, we’ll just look at the second most likely possibility.

Very often (one would like to say ‘as a rule’), the market faces a given level of 1.4400, touches a given level and leaves the ceiling of 1.4415 – 1.4420. If the instrument goes higher, it often indicates the negation of this level and it’s eventual break down further in the chart.

The right test can reverse from 1.4400 to 1.4420 but later it goes back down again, breaking the full level by 10-15 or 20 pips, ie to 1.4390. The most correct test can go back to 1.4400 but it does not go much above.

If it is above, this does not mean the negation of inheritance, however, the probability of decreases – thus decreases. If the rate goes further above the level of 1.4415-1.420, it indicates the potential negation of the full level or a re-test in the future.

When the rate from 1.4390 increases to 1.4400 and returns down again, we can observe whether it will break 1.4390, which we can call the symbolic descent of 10 pips below 1.4400.

This means we need to look for further sales and the dynamics. We observe the qualitative approach (the strength of price dynamics) and quantitative (number of pips). The price dynamics on Forex and on other markets, always dance until a negation or continuation occurs. IE 20 pips between the full level of 1.4400, or between 1.4420 & 1.4380 (or any other full support).

You only need to know the rules a currency market is making movements based on, and know the psychological aspects of traders within these transactions – and YOU WIN!

The basis is to find the right conditions to play the stock market. A very important issue in investing is good and reliable preparation for the process. However, many people skip this stage, which results in failure when investing in the stock market 99 out 100 times.

The end-game of the stock market is negative sum, never forget that. This is why investors have two basic goals. 1) Be more effective of an investor than other players 2) Be able to pay brokerage offices that give us the opportunity to access the market

Fortunately, today’s market functioning has changed. We can forget about going to the trading floors, where in the past brokers fought for the sale or purchase of securities for their clients.

Now, everything is done electronically. This has reduced costs and the investment process has been accelerated considerably. Although the costs have decreased, we still need to choose the right brokerage house to maximize the profit margins.

When setting up an investment account, it is first necessary to pay attention to the commission that must be paid for each transaction made. As a rule, it should be less than 0.4% of the transaction value.

Another thing to look at is the minimum commission amount. It is calculated when we carry out smaller orders, so if you are going to start with a small capital (€250-€10,000) it is certainly a matter worth considering. If you start investing while studying (like you are now), it’s worth asking for a special offer because a lot of brokerage houses have cheaper rates just for students.

Additional hidden fees can be a killer! These are fees associated with opening an account, its running, access to quotations and so much more! Often, brokerage houses tempt with low commission, but if we add in all the terms & conditions, it turns out that they have much higher fees than other leading brokers. As a result, it’s best to do research when choosing which brokerage house is best to open your account, usually via Google.

If you take any of our courses, I will recommend a few specific brokerage houses at each level of your experience. Beginners for one broker, pros for another broker. Each one has it’s own advantages, but you have to do the research to find out which one works best for you (and sometimes that’s 1/2 the battle)!

It is very important to determine your personal investment goal. it’s different for everyone, so KNOW YOUR GOAL.

For example, do you want to save your money and use it for retirement? Do you want to withdraw some money and take an exotic vacation or buy a new car?

When you first start, you need to ask what you expect of this entire journey. Once you have set your goal, now it’s time to consider what losses we can allow, what risk we are able to withstand. If you don’t know BOTH of these things, you are guaranteed to get lost in the greed of Forex.

It should be noted that the chance of profiting is just a side effect, which automatically connects to the possibility of an instrument taking off. That’s why you should not put all your savings into investing.

You need to determine which part of your capital you can afford lose, should the worst case scenario happen. To minimize the risk of losing money, you should not invest in start-ups or in those that already have financial problems.

If someone prefers more reliable profits in the long run, he should invest in companies that have an established position and have shown high financial results in the past.

On the other hand, for people who prefer a rate of return with a higher rate, they should invest in companies of smaller companies that show great development opportunities and have emerged in new markets.

The next step after determining your investment possibilities and allowable loss margins of your capital, is to select the right actions which will potentially give the largest and most reliable profit. You’ll need to first get an accurate and reliable analysis. There are many ways to analyze stock companies.

One of the most popular methods is technical analysis. It is based on the analysis of previous events, thanks to which it tries to predict what will be the next behavior of the course of the given action. It is used in liquid markets. Another fundamental method is fundamental analysis. It uses the perspective of the entire economy and the financial results of that given company.

It is up to each individual to determine which of these analysis methods he prefers to use. So far, there is no answer to which of these analyzes is more effective.

Once we have analyzed and bought the shares, there are a few more things to keep in mind. High volatility is the hallmark of stock markets. That’s why you should stay calm when moving in the stock market.

During unforeseen reactions in the market, it is first of all necessary to avoid ill-considered & hasty decisions. The vast majority of investments are of a long-term nature. Experienced investors emphasize the importance of psychology on the way to investment success.

Pip, short for Point In Percentage, is a very small measure of change in a currency pair in the forex market, (0.0001 OR 4 decimal places) is considered to be a single pip. The only exception among the main currency pairs is the Japanese yen (0.01 OR 2 decimal places). So if an instrument increases/decreases by 0.00040, then there are 4 pips OR 40 points.

Spread is shown in pips, showing the difference between the purchase price (bid) and the sale price (ask). If the spread is 0, it means that it is a no-cost transaction.

Tick is a measure of the minimum upward or downward movement in the price of a security.

Flight is a unit of measurement in Forex that determines the value of the contract, showing the value of 100,000 units of the base currency. For example, a purchase of 300,000 Euros, would be a purchase of 3 flights. Mini flights have a value of 10,000 and microlights a value of 1,000.

Margin refers to the percentage of capital needed to leverage on a investment instrument, allowing control of a larger position and an increase in the ROI. This allows leverage that an investor otherwise might not be able to purchase with their own starting capital. NOTE: The minimum account balance must always remain above 30% of the initial deposit. The value of the account can not fall to the level of 30% of the initial deposit.

Profits and losses are calculated according to the transaction value.

Corrections and the ability to distinguish between them is a key skill in Ralph Elliott’s theory of waves. The types of corrections and ways to distinguish between them are presented below.

A simple correction is a three-wave, simple formation. This is the most known and most frequently encountered corrective formation. It is denoted as ABC and its structure is 5-3-5. The peak of the B wave is well below the peak of wave A. These zigzags can occur twice or even three times if the last wave does not reach the level it was forecasted.

The flat correction has a different structure from the correction of the straight line. This difference consists in a different structure of the first wave. This means that wave A consists of three waves, and not as in the case of a zigzag of five.

However, the structure of the remaining waves does not change, therefore the B wave consists of three podfali, and the C wave of five. Thus, the structure of a flat correction is 3-3-5. They often appear in the period of strong growth trends and almost always occur before or after the lengthening. A flat correction often appears as a fourth wave, but almost never occurs as a second wave.

This correction occurs much more often than flat corrections, otherwise known as regular ones. The structure of this adjustment is 3-3-5. The peak of the B wave is higher than the beginning of the A wave, while the C wave has its end clearly lower than the end of the A wave.

Strong and fast markets – this is where speeding adjustments occur. However, adjustments of this type are quite rare. In this correction, the peak of wave B is higher than the beginning of the wave A. Wave C is quite short, which ends between the ends of waves A and B. If we are dealing with an upward trend, the end of the C wave usually falls a little below half wave B.

One of the methods for analyzing the graphs is the Fibonacci Indicator, created by an American engineer Ralph Elliott. It is based on the Fibonacci sequence discovered in the 13th century by Leonardo Fibonacci. What does the Fibboncci string look like and what is it about?

A bit of mathematics: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, etc…

The first two words of the sequence are always one, and the third word of the sequence and each subsequent is the sum of the two previous ones. Here are the types of Fibonacci Indicators in Forex:

Thanks to it, we report support and resistance levels. The purpose of its determination are three relationships: 38.0%, 50%, 62.8%.

We must have two opposite points: the top and the bottom. The distance between them must be determined. This is done to designate three lines according to the three above relationships. The lines are from the most protruding point from the left. These lines are called levels of support and resistance.

These are vertical lines defined on the graph, where the distance between them increases adequately to the Fibonacci sequence (1,1,2,3,5,8,13,18,21,34 …).

They inform us about the trend change or correction. The turning points of the trend are the intersections between the line and the graph.

They are somewhat similar to the Fibonacci fans. The trend line must run between two extreme points. On the length of this line, the following levels are determined: 38.2% 50%, 62.8%.

If we have calculated levels on the trend line, then we draw three arches, exactly in those places that are used as levels of support and resistance.

Fibonacci constraints are able to predict the scope of the correction with a high probability.

This indicator shows support and resistance levels. Elimination levels are: 23.6%, 38.2%, 50%, 61.8%, 76.4%, which are plotted as horizontal lines in the graph. Earlier, however, two extreme points of the trend should be combined.

If the trend correction wave breaks the level, for example 76.4% of the abolition, the level of 61.8% of the abolition is a potential level of support or resistance.

It is a combination of time analysis (Time Zone Indicator) and Price Analysis (Fiber Limits) and informs us about the time price combination for the main elevation levels.

In every business, breaks are needed to rest from the work you must do, often 6 days a week (especially as a Forex trader). The best traders in the world take time off from investing. Is this one of the secrets of their success?

Forex takes a lot of time from the life of every Trader, especially since many markets nowadays are open 24 hours a day, 5-6 days a week (Saturday and/or Sunday being the exception). In addition, there is always a lot to learn, new books to learn about, new theories to explore. Not to mention how much trading is pulling in, which fills investors for days. Through all these aspects traders forget about rest, a moment of respite away from the market and everything related to it. But in the end you have to stop and find time to relax.

The market encourages continuous online presence, control of the situation, continuous investment without a moment of rest. However, one should finally say stop and find a moment to break away from this world. Every good trader should separate these two issues in his life – you need to find time to invest, but it is equally important to find time to “charge the battery”, relax the body and mind.

Undertaking erroneous and ill-considered decisions is the main problem faced by traders who forget about rest. Learn from the best and do not duplicate their mistakes, find a moment for yourself, forgetting about the market, although for a moment.

Passion is the foundation for success in any business. Without proper commitment and devotion, it is difficult to be one of the best in a given field. However, it should be remembered that a chronic addiction to investing can only harm. Being passionate about trading is the key to winning, but you always have to remember the moment of respite.

Rest brings the cleansing of the mind, from all problems, helps us to look at the new issues in a new light, and often brings new ideas. After a moment of relaxation, the trader returns with energy and willingness to act again to face the problems posed by this market.

Here are some photos that show me away and resting from trading.

FOREXYESTRADER PROJECT SINCE 2010

12 YEARS OF EXPERIENCE TRADING

FOREX, FUTURES, STOCKS, CRYPTO

I CARRY OUT COURSES FOR THE BIGGEST BROKERS IN POLAND

WORKED FOR CITIBANK AND OSTC TRADING COMPANY